How to Start an LLC - Step-by-Step Guide.

Starting a Limited Liability Company (LLC) is one of the best ways to protect your personal assets while running a business. Whether you're an entrepreneur, small business owner, or side hustler, this step-by-step guide will walk you through the entire LLC formation process.

Why Form an LLC? Key Benefits

- Asset protection - Separates personal and business liabilities

- Tax advantages - Flexible taxation options (pass-through or corporate)

- Business credit - Easier to secure loans and financing

- Professional credibility - Enhances your brand reputation

- Minimal paperwork - Less compliance than corporations

Step 1: Choose Your LLC Name

Your business name must comply with your state's LLC naming requirements:

- Must include "LLC" or "Limited Liability Company"

- Cannot be confused with existing businesses

- Avoid restricted words (like "Bank" or "Insurance")

Pro Tip: Use a business name generator if you're stuck, and always check trademark databases before finalizing.

Step 2: Select a Registered Agent

Every LLC needs a registered agent to receive legal documents. You can:

- Appoint yourself (if you're available during business hours)

- Hire a professional registered agent service ($50-$300/year)

Top-rated services include Northwest Registered Agent, LegalZoom, and Incfile.

Step 3: File Articles of Organization

This is the official document to create your LLC. Key details:

- File with your state's Secretary of State office

- Fees range from $40 (Kentucky) to $500 (Massachusetts)

- Processing takes 2-3 weeks (or pay for expedited service)

Consider using an LLC formation service to handle paperwork and ensure compliance.

Step 4: Create an Operating Agreement

While not always legally required, this document is crucial for:

- Defining member roles and responsibilities

- Establishing profit-sharing arrangements

- Protecting your limited liability status

Use an LLC operating agreement template or have a business attorney draft one.

Step 5: Get an EIN (Employer Identification Number)

This is like a social security number for your business, required for:

- Opening a business bank account

- Hiring employees

- Federal and state tax purposes

Get yours for free from the IRS website or through your LLC service provider.

Step 6: Comply With State Requirements

Additional steps may include:

- Business licenses and permits (varies by industry)

- Annual reports and LLC fees

- Sales tax permit if selling products

Check your state's business portal for specific requirements.

LLC Formation Costs Breakdown

- State filing fees: $50-$500

- Registered agent: $0-$300/year

- Business license: $50-$400

- LLC service (optional): $0-$300

- Total Estimated Cost: $100-$1,500

FAQs About Starting an LLC

How long does it take to form an LLC?

Typically 2-3 weeks, but many states offer expedited processing (1-3 days) for an additional fee.

Can I form an LLC myself?

Yes, but using an LLC formation service ensures compliance and saves time.

What's the difference between LLC and corporation?

LLCs offer pass-through taxation and simpler compliance, while corporations can issue stock and have more complex structures.

Pro Tip:

Consider consulting with a business attorney or CPA if you have complex ownership structures or need help with tax planning strategies for your LLC.

You might also like

Popular Articles

How to Price Your Indie Game for Maximum Profit (Steam vs Itch.io vs Epic)

How to sell game assets on Unity Store

From Hobby to Profit: How to Turn Your Gaming Passion Into a $100K Business

AI Video Editing Tools Tested: Which Actually Save Time?

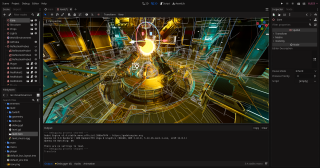

Best Game Engines for Beginners: Unity vs Godot vs Unreal Compared